Solid Assistance: Trust Foundations You Can Count On

Solid Assistance: Trust Foundations You Can Count On

Blog Article

Protecting Your Possessions: Trust Fund Structure Proficiency within your reaches

In today's intricate economic landscape, guaranteeing the security and growth of your assets is vital. Trust structures function as a cornerstone for safeguarding your wealth and tradition, giving a structured strategy to property security. Proficiency in this world can offer very useful assistance on browsing lawful complexities, making the most of tax performances, and producing a robust financial plan customized to your one-of-a-kind demands. By taking advantage of this specialized expertise, individuals can not just secure their possessions successfully but additionally lay a solid foundation for long-lasting riches conservation. As we discover the complexities of depend on foundation proficiency, a globe of possibilities unravels for fortifying your financial future.

Significance of Trust Fund Structures

Count on foundations play a critical role in establishing integrity and fostering solid connections in numerous professional setups. Count on foundations serve as the keystone for moral decision-making and transparent interaction within organizations.

Advantages of Expert Advice

Building on the structure of count on in expert partnerships, seeking specialist advice offers invaluable benefits for individuals and companies alike. Professional advice provides a riches of understanding and experience that can assist browse complicated monetary, lawful, or critical challenges easily. By leveraging the knowledge of experts in different fields, people and organizations can make enlightened choices that line up with their objectives and desires.

One substantial benefit of expert advice is the capability to gain access to specialized knowledge that may not be easily available otherwise. Experts can supply insights and point of views that can lead to cutting-edge options and chances for development. Furthermore, dealing with specialists can aid minimize dangers and unpredictabilities by giving a clear roadmap for success.

Furthermore, specialist assistance can conserve time and resources by simplifying procedures and avoiding pricey errors. trust foundations. Specialists can supply individualized advice tailored to particular demands, making sure that every decision is knowledgeable and strategic. Overall, the benefits of expert advice are complex, making it a useful property in securing and maximizing possessions for the long-term

Ensuring Financial Safety

In the realm of monetary preparation, protecting a steady and flourishing future rest on tactical decision-making and prudent investment choices. Making certain economic security entails a diverse strategy that incorporates various elements of riches management. One crucial element is producing a diversified investment profile customized to private risk resistance and monetary goals. By spreading investments throughout various property courses, such as stocks, bonds, real estate, and commodities, the risk of considerable economic loss can be reduced.

In addition, keeping a reserve is vital to protect against unexpected costs or earnings disruptions. Specialists recommend reserving three to six months' well worth of living expenditures in a liquid, quickly obtainable account. This fund works as a monetary safeguard, offering satisfaction during turbulent times.

On a regular basis evaluating and readjusting monetary plans in reaction to altering conditions is likewise paramount. Life events, market variations, and legislative adjustments can impact financial security, emphasizing the significance of ongoing assessment and adaptation in the search of long-term economic protection - trust recommended you read foundations. By carrying out these approaches thoughtfully and consistently, individuals can strengthen their monetary ground and work towards a more secure future

Protecting Your Assets Properly

With a solid foundation in position for economic safety through diversification and reserve maintenance, the next important step is protecting your assets effectively. Securing assets entails protecting your wide range from prospective threats such as market volatility, financial slumps, suits, and unpredicted expenditures. One efficient approach is possession allocation, which entails spreading your investments throughout various asset courses to decrease danger. Diversifying your portfolio can aid alleviate losses in one area by stabilizing it with gains in an additional.

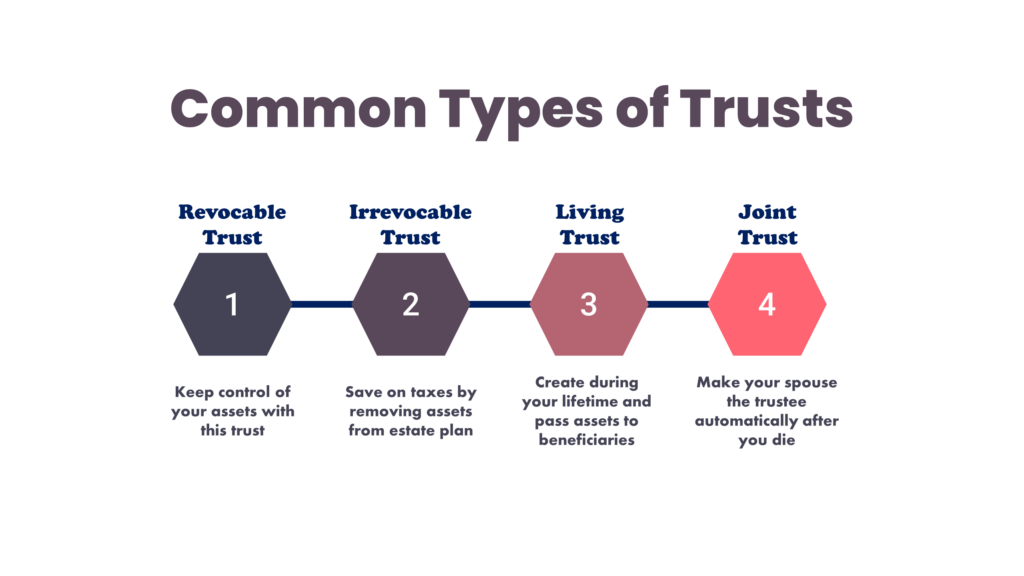

Additionally, developing a trust fund can supply a safe and secure method to secure your assets for future generations. Trusts can aid you manage how your possessions are distributed, reduce inheritance tax, and secure your riches from lenders. By applying these techniques and looking for professional suggestions, you can guard your possessions properly and protect your economic future.

Long-Term Property Security

To make certain the long-term security of your riches versus prospective risks and unpredictabilities with More Bonuses time, critical preparation for long-lasting possession defense is important. Lasting asset security includes carrying out actions to safeguard your properties from various hazards such as financial recessions, lawsuits, or unanticipated life events. One critical element of long-term possession security is establishing a trust fund, which can offer significant advantages in shielding your possessions from creditors and legal conflicts. By moving possession of possessions to a depend on, you can protect them from prospective risks while still retaining some level of control over their administration and distribution.

Furthermore, find out this here diversifying your investment portfolio is one more crucial approach for long-lasting property defense. By spreading your investments across different asset courses, industries, and geographical regions, you can decrease the impact of market variations on your general riches. Furthermore, on a regular basis examining and updating your estate strategy is vital to guarantee that your possessions are safeguarded according to your desires in the long run. By taking a proactive method to lasting possession defense, you can secure your riches and supply monetary protection on your own and future generations.

Conclusion

In conclusion, trust fund structures play an essential function in protecting properties and making certain economic safety and security. Professional assistance in establishing and handling depend on structures is vital for lasting possession security.

Report this page